AITAH for Not Wanting to Pay for My Brother’s Wedding After He Spent All His Savings on a Sports Car?

When family and money collide, someone almost always ends up feeling betrayed. Today’s AITAH scenario explores a question that hits close to home for anyone who’s worked hard for their savings—are you obligated to bail out a loved one when their priorities don’t align with yours?

Let’s dig into this contentious story.

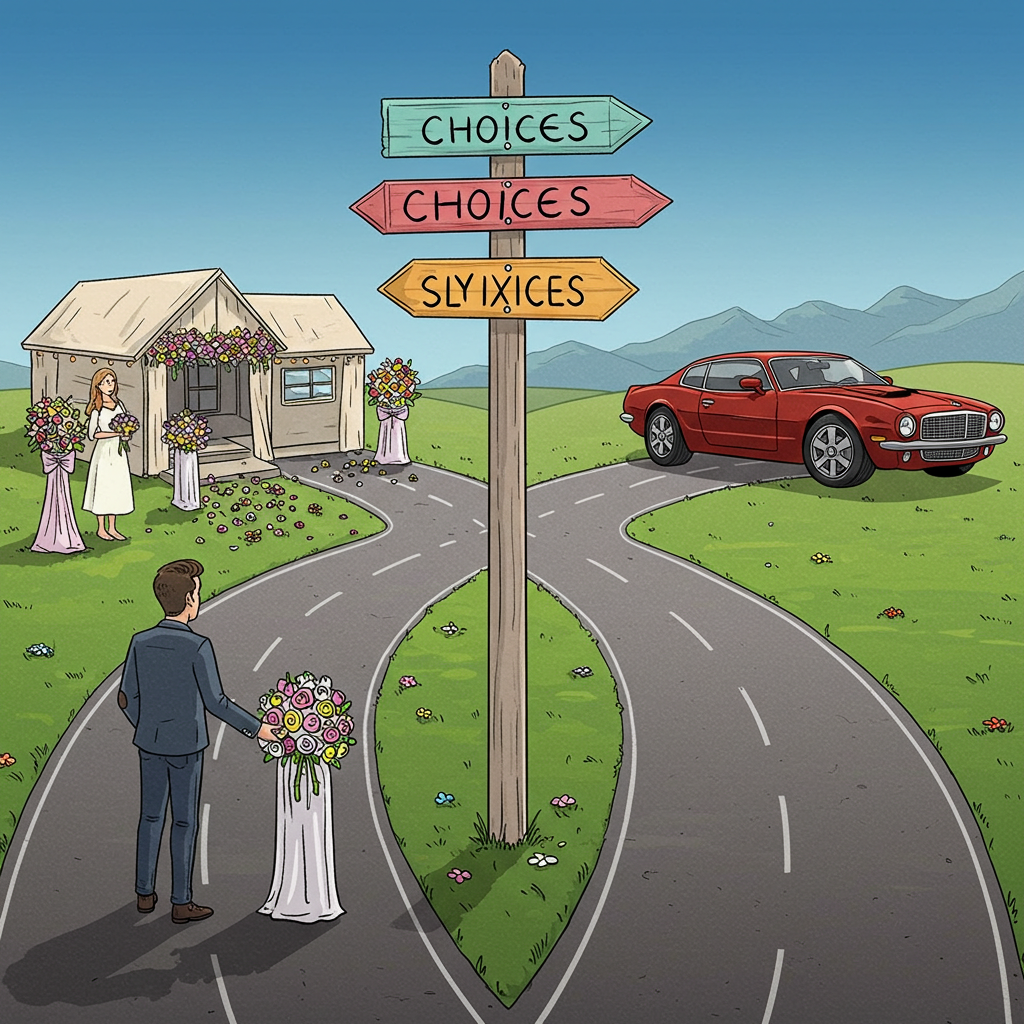

The Situation: A Car Today, a Wedding Tomorrow

A 33-year-old woman—let’s call her Sara—shared her story on r/AITAH. Sara has always been careful with money. She built up a substantial emergency fund and keeps her expenses low. Her younger brother, Kevin, 28, has a different philosophy: he believes in “living for today.”

Kevin recently bought a brand-new luxury sports car, paying for it almost entirely in cash. His reasoning? He wanted to enjoy life before settling down.

Fast forward six months. Kevin proposed to his girlfriend, and they began planning an extravagant destination wedding. When it came time to book the venue and vendors, Kevin discovered he didn’t have enough money left to cover the costs.

That’s when he approached Sara.

The Big Ask: “You Have the Money—Why Won’t You Help?”

Kevin asked Sara to contribute $20,000 toward the wedding. He argued that she could easily afford it and that family should support each other’s milestones. He also reminded her that their parents had passed away and that, as siblings, they only had each other.

Sara refused.

She told Kevin that while she was happy to buy a gift and maybe help in small ways, she didn’t feel comfortable funding a lavish wedding—especially after he had chosen to spend his savings on a car.

Kevin was outraged. He called her selfish and cold-hearted, accusing her of caring more about her bank balance than her brother’s happiness.

Sara turned to Reddit: Was she the villain for refusing to pay for the wedding when she could technically afford it?

The Dilemma: Is Financial Responsibility Selfishness?

The Case for Sara: Hard Work and Priorities

Sara didn’t inherit her savings. She built her financial safety net through discipline and sacrifice. Helping Kevin cover wedding costs would deplete funds she set aside for her own future and emergencies.

Moreover, Kevin’s financial situation wasn’t due to hardship or unforeseen crisis—it was the result of a conscious choice to buy a luxury vehicle.

As many Reddit commenters pointed out, Sara’s refusal wasn’t about denying help; it was about not rewarding irresponsible spending.

The Case for Kevin: Family Support

From Kevin’s perspective, Sara’s refusal felt like a betrayal. He saw her as his last safety net and believed she should share her good fortune—especially for something as meaningful as a wedding.

In his eyes, Sara’s success came with an unspoken duty to help those she loves, no matter the circumstances.

Reddit Responds: Is Sara the Villain?

The r/AITAH community overwhelmingly supported Sara.

“You’re not the villain for refusing to subsidize someone else’s poor choices,” one commenter wrote. “That’s enabling, not helping.”

Another user added, “He had the money. He just chose to spend it on something flashy. Now he wants you to foot the bill? Absolutely not.”

Still, a minority argued that if Sara wanted to maintain a good relationship, she could have offered a smaller contribution—perhaps a few thousand dollars to ease tensions.

Boundaries and Enabling: Where to Draw the Line

The Cost of Bailing Out Loved Ones

This story raises an important question: Does having money obligate you to share it when family asks?

Many people feel guilted into saying yes—especially if they’re more financially stable than their relatives. But bailing someone out after reckless decisions can set a precedent:

-

They may expect you to fund future expenses.

-

They might never learn to budget responsibly.

-

You could end up resenting them and damaging the relationship.

Establishing clear boundaries, as Sara did, is often healthier in the long run—even if it causes temporary hurt feelings.

Alternatives to “No”

That said, refusing doesn’t have to mean abandoning the relationship. Sara could consider:

-

Offering a smaller, specific amount as a wedding gift.

-

Helping with non-financial contributions, like planning or logistics.

-

Encouraging Kevin to cut costs and rethink priorities.

A Lesson in Priorities: Weddings vs. Financial Stability

It’s natural to want a memorable wedding. But when the choice comes down to a car or a celebration, there’s a hard truth: you can’t have both unless you plan responsibly.

Kevin’s situation is a reminder that major purchases have consequences—and sometimes, those consequences mean scaling back your dreams.

The Takeaway: Boundaries Aren’t Betrayal

Saying no to a loved one doesn’t make you the villain. It means you value your own financial security and believe in personal accountability.

Sara’s refusal wasn’t about punishment—it was about protecting the savings she worked hard to build.